Automate your accounting with Parex Bridge

Leave all your accounting worries for your ecommerce sales to our system

Integrate your Ecommerce* sales with your accounting system in QuickBooks or Xero or Sage

Get Started

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

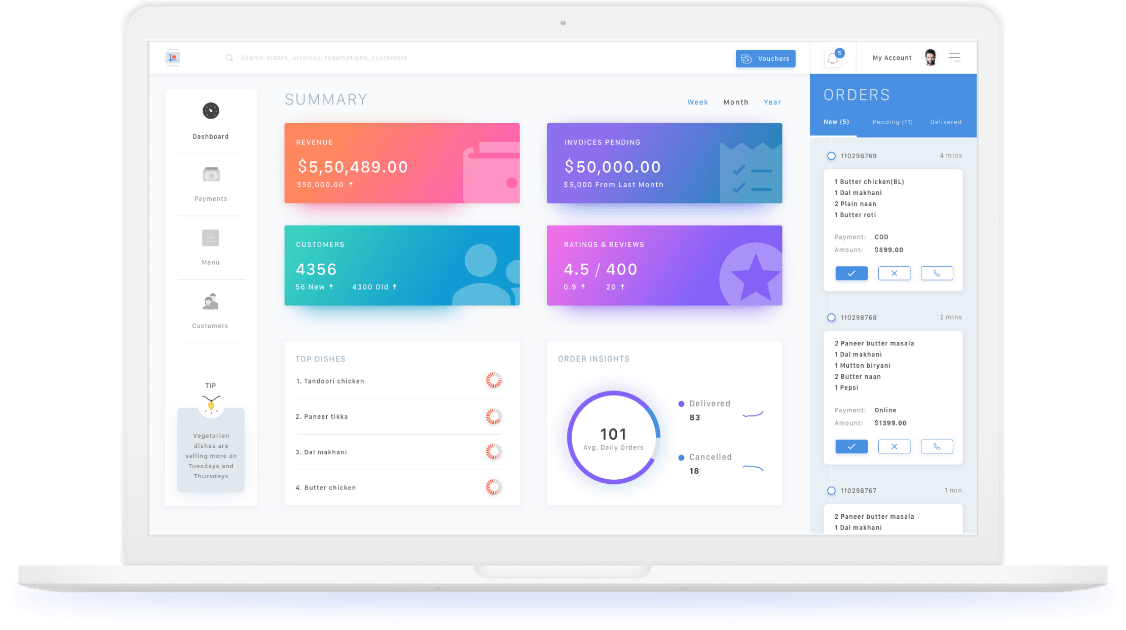

Clean and simple app, Comes with everything you need to get started!

Complete Order Data Sync

When an order is synced from Ecommerce to QuickBooks or Xero or Sage, all order information will be synced.

Automated Daily Process

You can automate sync to QuickBooks or Xero or Sage or prefer to do it manually at your convenience.

Easy Integration

You are ready to sync your data with just a few clicks. Connect Your store, Connect QuickBooks or Xero or Sage, Complete the required settings, And that's it.

Quick & Easy to Use Bridge App

You need not be an expert in accounting to setup this app. You can get the app up and running in as little as 5 minutes. Sync to QuickBooks or Xero or Sage with ease and comfort.

Premium App with all Essential Features

We have taken into consideration the hassles that all the e-commerce entreprenures go through while doing their accounting sync. We let you focus on your business and leave your accounting worries to us. Accountants & CPA make the app even better with the app helping them do tedious entries while they focus on bigger tasks.

Crafted for unique needs & global reach

Our team has put in our hearts to make this app robust and flexible so that you can make the best use of the accounting system while still providing the service at an affordable rates. Moreover, we have also made it smooth for sellers across the globe to use it with ease based on the Taxation and other regulations in your country.

Our Pricing

Stop spending your time and money in tiring manual entries in accounting softwares. Automate it with accuracy. Happiness guaranteed!

Silver

US $10per month

$0.05 for additional orders over 100 orders.

- Includes 100 orders/month

- $0.05 for additional orders over 100 orders

- Best For Startup selling

- Email Support Only

Gold

US $20per month

$0.02 for additional orders over 800 orders.

- Includes 800 orders/month

- $0.02 for additional orders over 800 orders

- Best For growing business

- Email Support Only

Platinum

US $30per month

$0.01 for additional orders over 2000 orders.

- Includes 2000 orders/month

- $0.01 for additional orders over 2000 orders

- Best For rapidly growing business

- Email Support Only

Desktop

US $40per month

$0.05 for additional orders over 1000 orders.

- Number of Orders : 1000

- QuickBooks Desktop Only

- Shopify Only